Innovative B2B Solutions for Buying and Selling Goods, Supplies, & Alcohol

For 35 years, we’ve helped business relationships thrive. Today, we use automation and AI to remove friction across the entire procure-to-pay process—from automated invoice processing, including complex alcohol transactions, to smarter inventory cost control, shrink reduction, and the elimination of out-of-stocks. With new price book and order management automation, we’re replacing slow, manual work with fast, reliable, end-to-end efficiency.

Attention California Retail & Hospitality Businesses:

The deadline to comply with the new wholesale alcohol EFT law has passed. If you are looking for a compliant way to pay distributors, you can self-sign-up for Fintech’s free plan here.

Trusted by Over 300,000 Businesses

Solutions Built for Your Business

Fintech identifies and removes bottlenecks that occur inside your procure-to-pay process.

Retail Stores

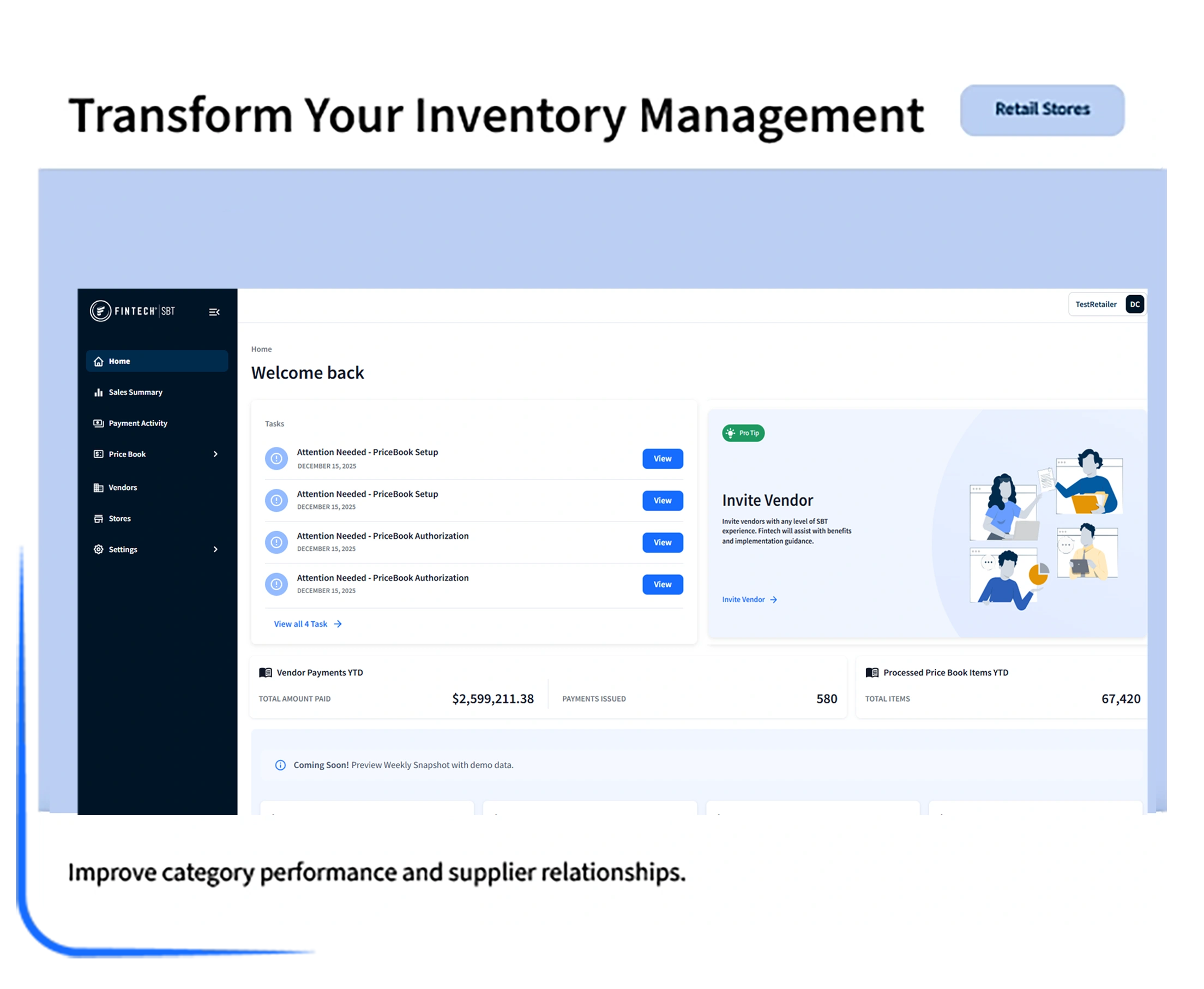

Take control of your inventory costs and optimize your invoice processes with powerful automation built for retail success. We help you save time, reduce inventory and AP expenses, and gain the insights needed to serve your business better.

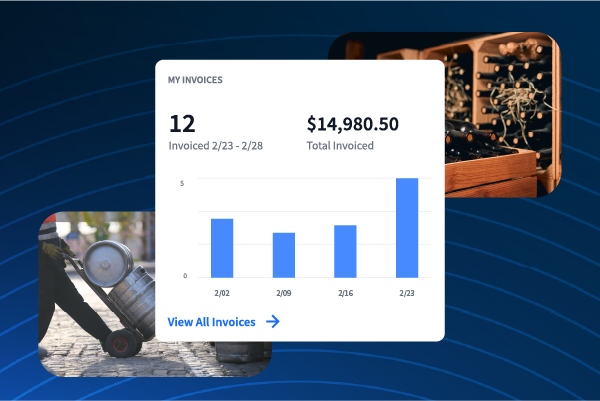

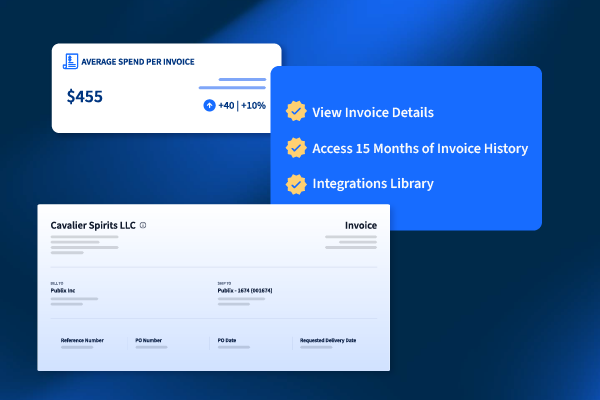

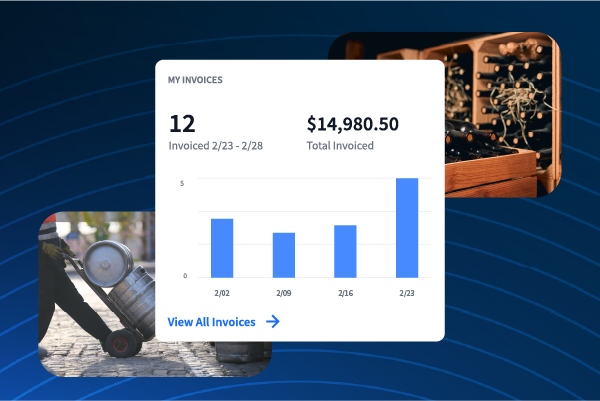

Effortless Invoice Processing

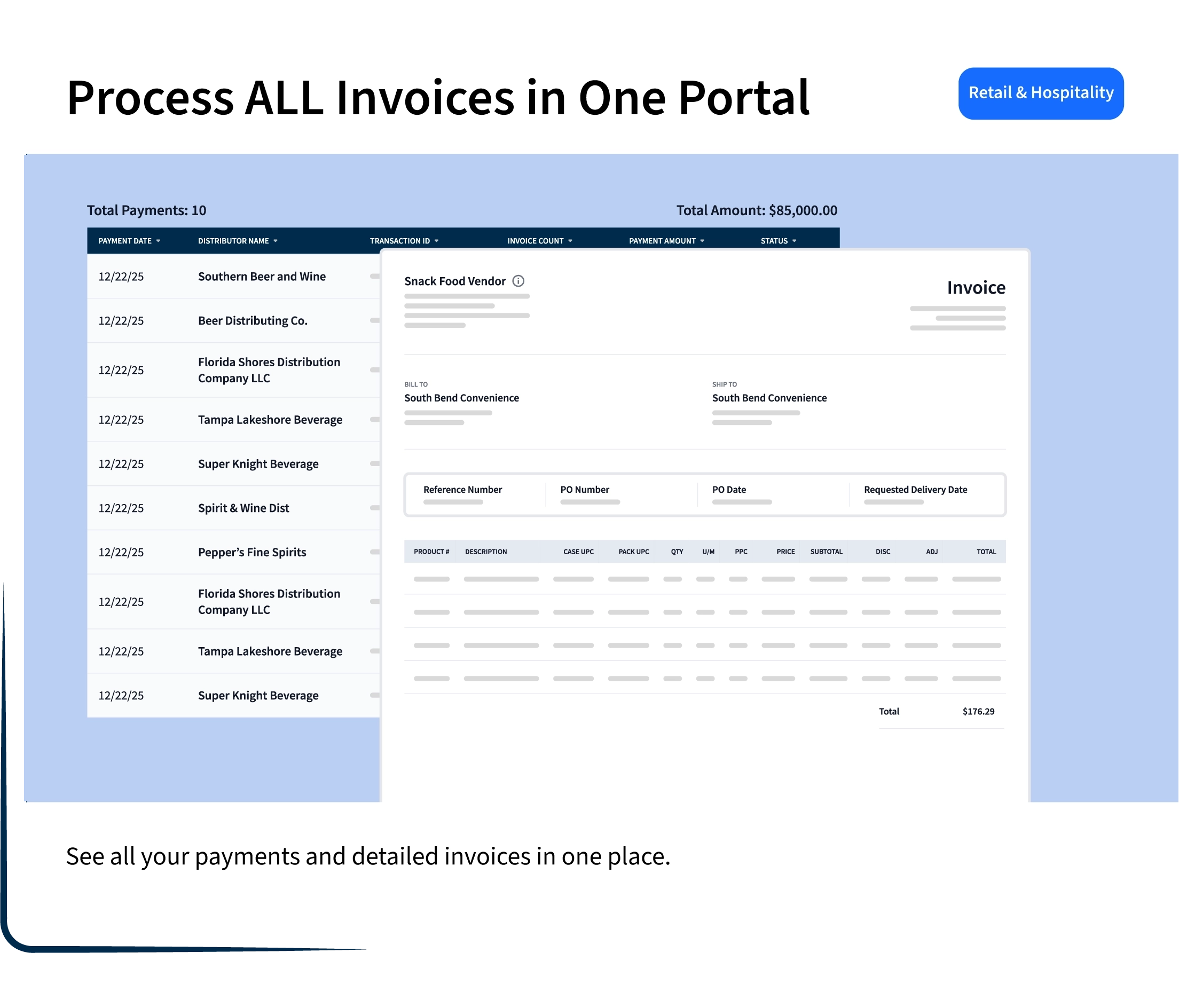

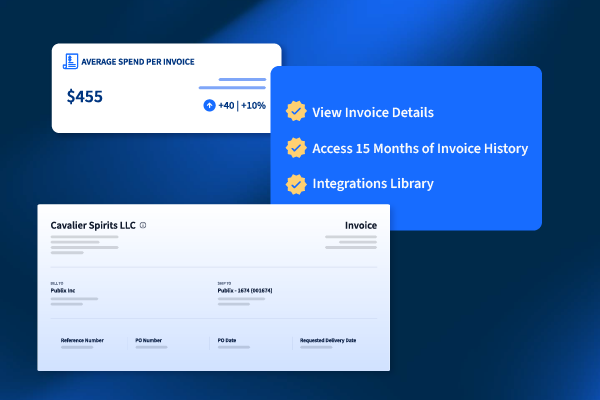

Manage and pay all business invoices, including regulated alcohol purchases with PaymentSource®. Automate data capture, reporting, and integrate with your back-office system to receive one file with all your clean invoice data, giving you clear insights to optimize your spending and grow your business.

Smarter Inventory Management

Eliminate upfront inventory costs and reduce shrink with our Scan-Based Trading product. Only pay for inventory that you sell, test new SKUs with low risk, improve forecasting and promotional timing, and adapt rapidly to customer demand.

Hospitality Businesses

Spend less time on manual back-office tasks and financial reporting. Spend more time in the front of the house creating exceptional guest experiences.

Automated Invoice Management

PaymentSource automates payments for food, supplies, and regulated alcohol, standardizes your invoice data, and delivers one clean invoice file directly into your back-office system for simplified reconciliation

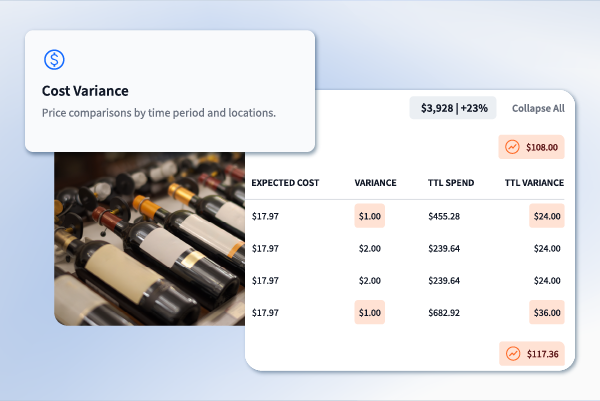

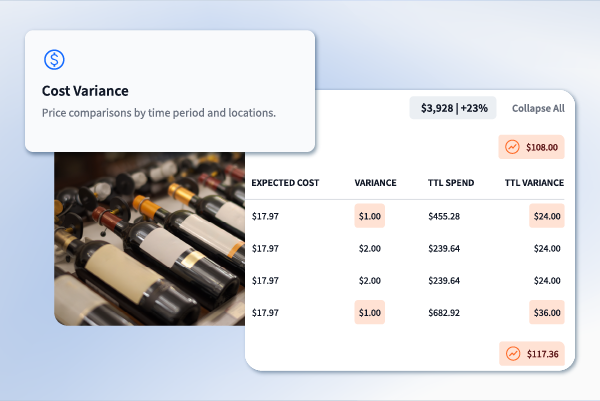

Insights to Protect Your Profits

Fintech offers several personalized spend reports, including Cost Variance, Top Spend by Distributor, Top Spend by Product, and Expected Cost Analysis, which flags discrepancies between what you expect to pay and your invoiced costs so you can take action to balance the books.

Alcohol Distributors & Suppliers

We have AR automation solutions for collecting alcohol invoice payments as well as tools built exclusively for suppliers to help secure placements and improve sales.

Automated Invoice Payment Collection

Get paid on time every time with PaymentSource. Fintech facilitates automated electronic alcohol invoice payments – including regulated COD (cash on delivery) or term payments – between you and your retail partners.

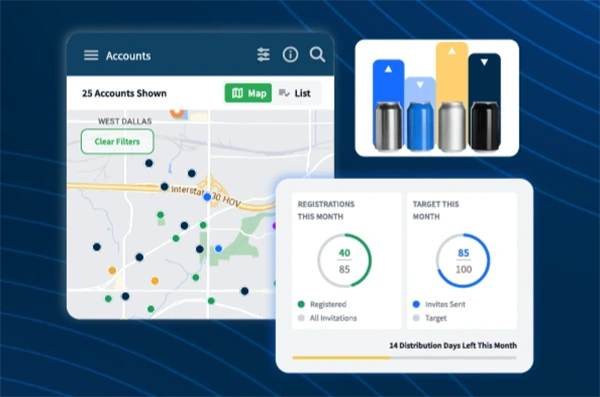

CRM & Alcohol Scan Data Insights

Sell more confidently with a dedicated CRM that allows you to track placements, account visits, promotions, and more. Fintech also offers exclusive alcohol scan data insights to analyze competitor activity, spot emerging trends, and prioritize opportunities.

All Other Distributors & Suppliers

Utilize Fintech as your one source for invoicing all your retail partners and transform the way you manage inventory.

Automate Your AR Processes

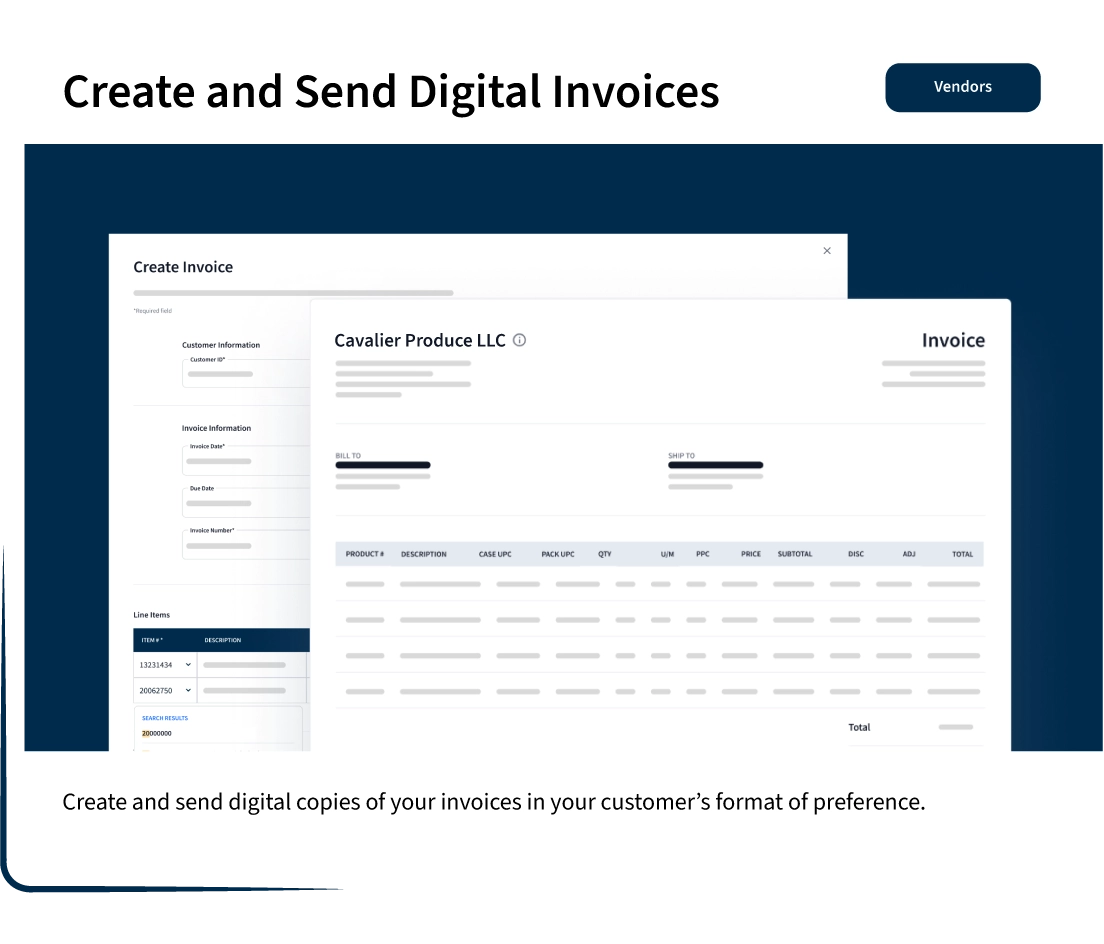

Fintech removes the burden of delivering invoices, collecting payments, and reconciliation across accounts. Send one invoice file to Fintech and we'll format and send individual invoices to your various trading partners. Collect electronic invoice payments through Fintech or continue to receive invoice payments through your existing AR system.

Manage Your Inventory

Use our Scan-Based Trading product to receive accurate, reconciled POS sales and delivery data that creates better retailer collaboration. Gain access to SKU- and store-level insights to improve inventory forecasting and production, reduce shrink, and increase margins with proactive exception detection.

Solutions Built for Your Business

Fintech identifies and removes bottlenecks that occur across your procure-to-pay process using automation technology.

Take control of your inventory costs and optimize your invoice processes with powerful automation built for retail success. We help you save time, reduce inventory and AP expenses, and gain the insights needed to serve your business better.

Effortless Invoice Processing

Manage and pay all business invoices, including regulated alcohol purchases with PaymentSource®. Automate data capture, reporting, and integrate with your back-office system to receive one file with all your clean invoice data, giving you clear insights to optimize your spending and grow your business.

Smarter Inventory Management

Eliminate upfront inventory costs and reduce shrink with our Scan-Based Trading product. Only pay for inventory that you sell, test new SKUs with low risk, improve forecasting and promotional timing, and adapt rapidly to customer demand.

Spend less time on manual back-office tasks and financial reporting. Spend more time in the front of the house creating exceptional guest experiences.

Automated Invoice Management

PaymentSource automates payments for food, supplies, and regulated alcohol, standardizes your invoice data, and delivers one clean invoice file directly into your back-office system for simplified reconciliation

Insights to Protect Your Profits

Fintech offers several personalized spend reports, including Cost Variance, Top Spend by Distributor, Top Spend by Product, and Expected Cost Analysis, which flags discrepancies between what you expect to pay and your invoiced costs so you can take action to balance the books.

We have AR automation solutions for collecting alcohol invoice payments as well as tools built exclusively for suppliers to help secure placements and improve sales.

Automated Invoice Payment Collection

Get paid on time every time with PaymentSource. Fintech facilitates automated electronic alcohol invoice payments – including regulated COD (cash on delivery) or term payments – between you and your retail partners.

CRM & Alcohol Scan Data Insights

Sell more confidently with a dedicated CRM that allows you to track placements, account visits, promotions, and more. Fintech also offers exclusive alcohol scan data insights to analyze competitor activity, spot emerging trends, and prioritize opportunities.

Utilize Fintech as your one source for invoicing all your retail partners and transform the way you manage inventory.

Automate Your AR Processes

Fintech removes the burden of delivering invoices, collecting payments, and reconciliation across accounts. Send one invoice file to Fintech and we’ll format and send individual invoices to your various trading partners. Collect electronic invoice payments through Fintech or continue to receive invoice payments through your existing AR system.

Manage Your Inventory

Use our Scan-Based Trading product to receive accurate, reconciled POS sales and delivery data that creates better retailer collaboration. Gain access to SKU- and store-level insights to improve inventory forecasting and production, reduce shrink, and increase margins with proactive exception detection.

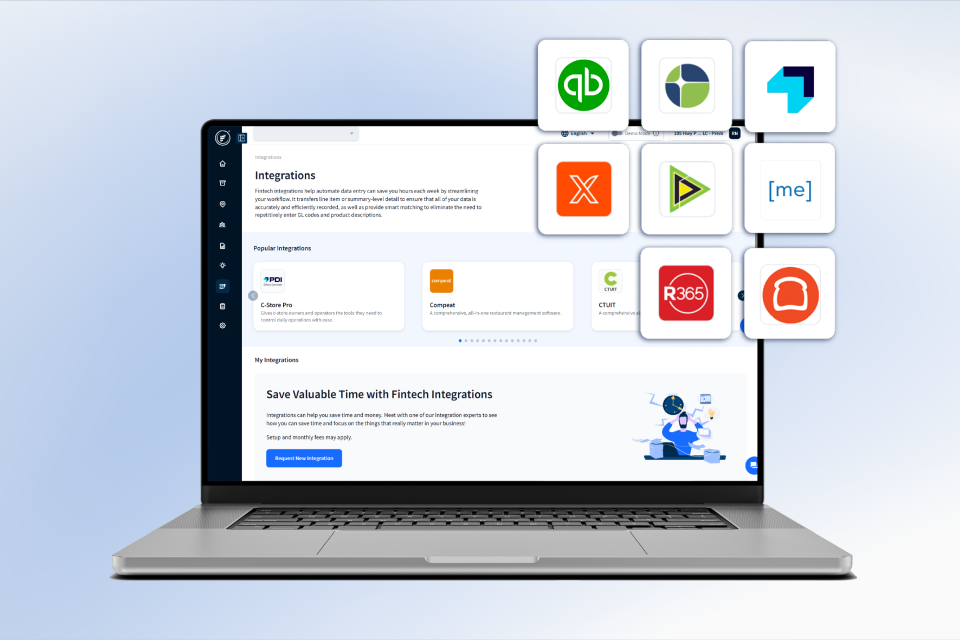

Built to Integrate with Your Systems

With more than 1,200 managed integrations, Fintech seamlessly exchanges invoice, payment, and remittance data across your ecosystem. Supporting EDI, APIs, CSV, and custom file formats, we enable secure, reliable data flow between our clients, their financial systems, and their trading partners.

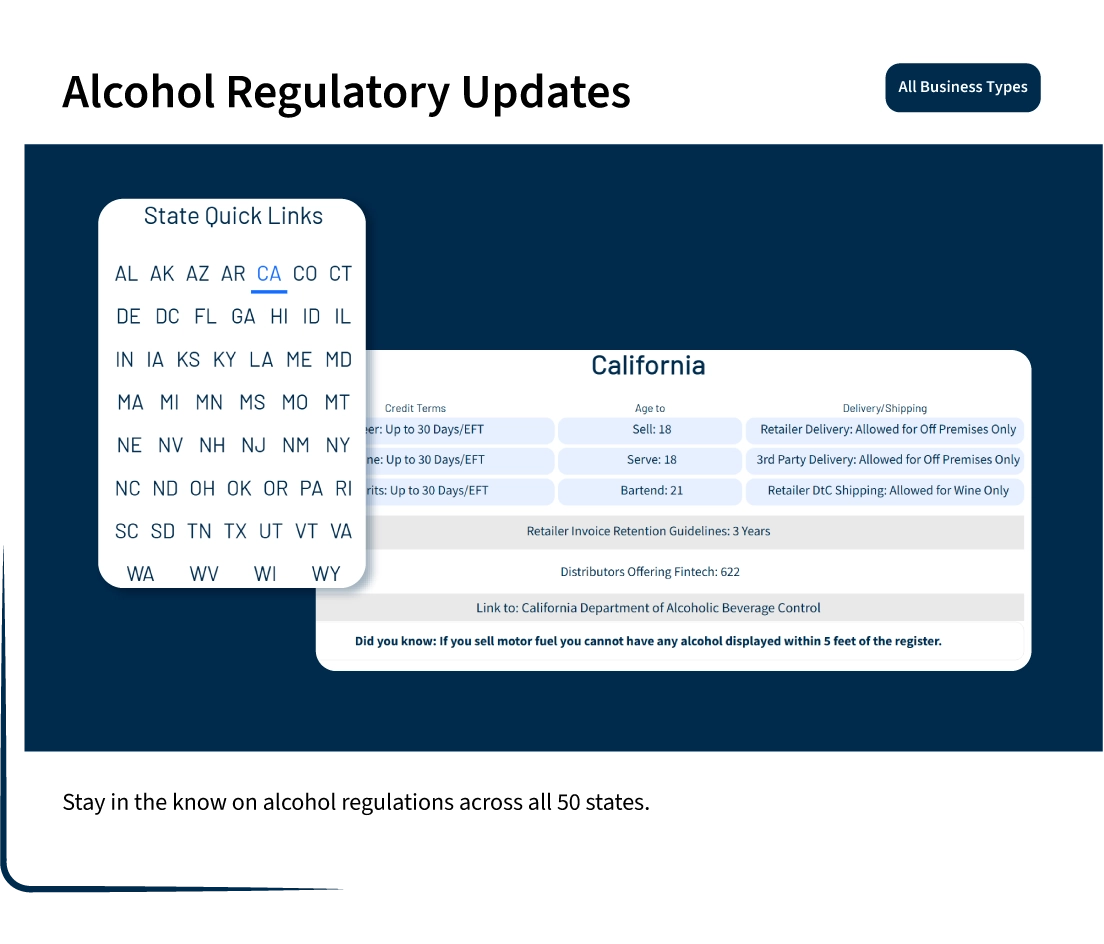

Stay Informed on the Latest Alcohol Regulations

Navigating alcohol laws can be complex. We break down the latest state-by-state rules so you can stay compliant and focus on your business.

Empowering growth through client focus and innovative solutions.

We use Fintech’s PaymentSource to automate invoice data entry from 43 vendors. Today that’s data from 7,500 invoices monthly received without manual entry mistakes. This automation saves our Pricebook Management and Internal Auditing teams 10-15 hours every week in each department, not to mention the hours saved for our AP team.

Pam Miller

Operations Controller

I am ecstatic over Fintech. It has completely changed the way we receive payments in the best way possible. I look forward to more and more of our customers transition to the platform.

Susan Beckman

Controller

Fintech has helped streamline our ordering and record-keeping process. Prior to coming on-board, we were managing accounts across 4 major distributors - each with a different delivery schedule and invoicing system. Fintech keeps things tidy in the backend by providing a centralized location for billing and order records, saving our accounting team time and energy.

Margaret Cooper

Director of Events and Logistics

First, let me say, you and your team over at Fintech have been doing a phenomenal job at getting our customers set up for EFT. I realize what an undertaking it is, and I marvel at the skills and efficiency of the Fintech team for pulling off this enormous task.

Deanna Soulliere

Office Manager

Fintech has helped as grow by allowing us to manage our back-office headcount effectively. Over the past two years, we've added 20 locations without expanding our finance department. As we transitioned vendors to automation and EDI our workload concerns eased, and we are able to scale efficiently while maintaining a lean operation.

Terry Valdivieso

Chief Financial Officer

Accounting departments love using Fintech. Its line-item integration into different systems make invoice and data tracking simple. Fintech can take invoices with mixed payment rules, for example if there is a 30-day payment processing rule for beer and wine but cash-on-delivery for liquor, and pay them accordingly and automatically. Its master login for all accounts is a game changer. I honestly don’t see a downside.

Stacy O'Fallon

Certified Managerial Accountant & Owner

Fintech In the News

Scan-Based Trading: A Strategy for High-Shrink Categories

“Innovative inventory management strategies, such as scan-based trading (SBT), are being deployed to more effectively manage the retailer and supplier relationship.”

Atlantis CFO Shares Her Strategy on Scaling Operations

“Having a partner like Fintech where we can centralize all our invoice data helps us scale our business.”

Adaptive Inventory Models That Drive Seasonal Sales

“Innovative solutions such as scan-based trading, where suppliers retain ownership of products until they are sold at the retailers’ POS, can be an effective tool for stocking seasonal items.”